We probably sound like a broken record at this point, but it bears repeating. Customers do NOT spend much time engaging with sales teams. And not just your sales teams. It’s all the sales teams they’ll engage with during the buying process. Alastair Woolcock spoke about how you can sell efficiently within that small window of time in his DEMOFEST 2022 session. Below are his insights from that session, but you can watch the full keynote session here.

If you look at how much time buyers are spending with vendors today, including all of the investments and all of their technology, it’s not much. It’s only 17%. That’s the amount of time that an average buyer today is spending with all vendors in their buyer journey. This is significant since the interactions we have with prospects are the fundamental ways we drive revenue. This is especially true for sales engineering as they engage and support buyers.

This doesn’t mean that customers aren’t spending significant time researching options in their buying journey, they’re just not going to vendors to get the information. Instead, they’re looking in other places for thought leadership, they’re using digital assets, they’re using your sites or review sites, and they’re engaging with third party firms.

With all this information available to customers at any time, we have to change the way we engage with customers. When we engage, the focus should be on supporting the buyer with what they need to complete their objectives rather than focusing on what we’re going to do to sell to them. It may sound counter intuitive, but it is where the market is going.

If you need more proof, just look at the impact this has had on quota attainment. Today 2/3 of all professional sales reps are missing their quotas. It’s a problem that’s affecting our abilities to grow and develop our businesses. But if we think it’s hard to sell right now, which it is, it’s more competitive than ever, it’s actually equally as hard to buy.

Playing Telephone

The simplest way to make selling easier, is to make it easier for people to buy. When you’re selling to a prospect, that prospect has to convince a lot of other people at their organization that this is the best solution. These days, buying groups can contain anywhere between 7 and 13 stakeholders depending on the size of the deal.

Selling quickly becomes a game of telephone. We say one thing during a demo, a demo that might only have 2 or 3 members of the buying group, and then they have to turn around and explain everything to their colleagues. If you think they’re getting the information correct, just think how a simple phrase in the game telephone gets muddled.

They’re trying to win the game of telephone, they’re trying to convince everybody else that this is the problem their organization is facing and our solution is how they can solve it. If we aren’t helping the buyer win that game of telephone by supporting their tasks systematically in every stage, we’re leaving our fate up to the buyer’s interpretation of our messaging.

The irony of all of it is, over 77% of all buyers say it’s actually hard to buy from vendors. I don’t know of any vendor worldwide that attempts to make it difficult to buy from themselves. They want to engage, they want to help, but there’s a massive disconnect between what the buyers need and how we engage with these buyers.

Changing Channels

Part of the challenge comes from the fact that customers use more channels than they used to. In 2016, there were around 5 different channels buyers typically used and many of these are still used today. These include:

- In-person

- Phone

- Supplier website

- E-procurement portal

By 2019, that number went up to about 7.5. Still pretty manageable, but with the addition of mobile apps and trade shows. Then the world changed with the pandemic and now it’s 2022. That number climbed again to 10. That’s double what it was in 2016 even with the removal of larger events.

So now the list of channels looks something like this:

- In-person

- Phone

- Supplier website

- Procurement department

- Mobile app

- E-mirco portals

- Video Conference

- Web chat

- Web search

Taking that past experience, you can estimate where we’re going to be by 2025. Low estimate 12 channels, high side closer to about 15 within the next 36 months. 15 different places people are going to complete their buying journey, and we have to meet them where they are.

How do we engage with them, how do we support them, and how do we scale the engineering side? Video and virtual meetings are now front and center with events like DEMOFEST, but that’s not always what the customer is looking for. They’re looking at things online, they’re looking at demos broken down into bite sized chunks, they’re trying to share these things across their organization.

The Impact to Demos

Demo volume is at an all time high because buyers are able to schedule a demo with a click.

Then the expectation is they can request a relentless number of demos. Customers start to ask, “Could you just do another demo? Could we get on with another department? Could I get somebody else from my buying group involved?” It’s all good for engagement, but it makes the cost of revenue very expensive.

Then we see time to value requirements are down massively. Time to value is one of the most important factors buyers use today when evaluating vendors. Currently, it’s down to less than 90 days. For context, before 2019 on average your solution could take about 9 to 18 months to start showing results.

Now, they’re looking for value in the 60 to 90 day window. The problem we agree we’re solving has to actually be solved in one quarter. That means we have to break down these problems into smaller chunks.

These factors are also leading to lower conversion rates. We’re spending more on technology than ever before. Sellers are selling less, they’re doing more work, there’s more tools helping us engage, and yet we’re converting less. As a result, our buyers are taking all this comparable information and channels, then cooking up ad-hoc projects and creating additional plans beyond what they were originally thinking. This creates more competition often coming from inside their own organization, in addition to your classic competitors.

Keep Customers Engaged

The way to fix this is to make sure you thoroughly engage with the customer during those rare moments when you have their attention. There are 4 basic things that will almost certainly get clients to disengage if they occur.

- Weak knowledge of the business situation and vertical industry – Customers are looking for contextualized experts around the business situation they’re in as well as some domain vertical knowledge. You have to understand precise situations and problems and how that applies to vertical competitiveness of what they’re doing as an organization.

- Compliance and security risk – What are the compliance and security risks of using your solution including the repercussions it will have on the rest of the organization. 67% of the time it is overlooked by both the buyer and the seller until way too late in the sales stage, creating a problem that SEs need to talk through.

- Lack of implementation plans – There’s a real lack of implementation plans and guidance coming from vendors. Customers are looking for a detailed understanding of how your solution works for their unique situation. This actually ranks as the number one expectation for mid funnel sales engineers.

- POCs fatigue and duration – POCs take a lot of effort to complete, especially when they’re looped into part of the demo. Think about the mental capacity of your audience after already experiencing an hour-long demo process. Break the demo process and POC process into hyper personalized bite size chunks by role.

Failing to address these can add a minimum of 2.6 months to any buyer journey. Not only does this stall your deal, it allows for more competition and additional internal projects to further disrupt the process.

The Importance of Business Cases

Business cases are essential especially for B2B sales, which now represents over 43% of IT spend and 80 to 90% non-IT spend. You need short form business cases up front and long form validation at the end. This is critical to assist buyers get their buying groups online.

No matter who you’re selling to, 92% of the time of a business case is needed. It’s a step that cannot be overlooked or presented at the close of a deal. If you are not helping build a business case at the front of the funnel development with your buyers, you are not supporting them correctly.

This is a buyer enablement concept that deviates from a linear sales process and acknowledges there’s a series of tasks the buyers have to complete as they move through the sales process.

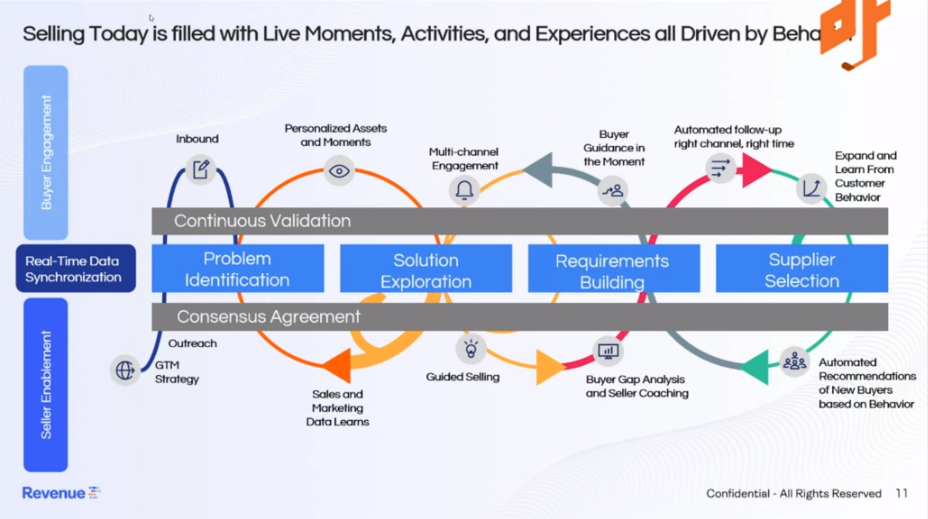

Let’s look at this from a task based perspective. Buyer’s have a set of tasks they have to complete in order to be able to buy and these tasks often fall into some basic buckets. These tasks don’t necessarily happen in a progressive order. Instead, customers complete these tasks whenever they pop up like a game of whack a mole.

Buyer Taks:

- Problem identification

- Solution exploration

- Requirements building

- Supplier selection

- Validation

- Consensus or agreement

Remember, they’re also trying to look at this as a larger group within their organization, so each time you see a task, ask yourself is it shareable, is it contextual, is it something that they can take to the rest of the buying committee?

Because you’re only getting 17% of the engagement time, so we have to think about how we’re supporting that. As you break this apart, think about how we continuously validate and how we create consensus across every step as we go.

It ends up looking something like this. It’s chaotic, but it’s the view of all of the actions that happen during the buying process. And they happen bidirectionally, meaning we’re often moving backwards while we’re also selling forwards. The process is a big mess and it’s hard to do.

Buyer Task Cheat Sheet

Thinking through this process with end task orientation is a great way to solve this problem because all of this requires real time data and real time synchronization. Take these basic examples of tasks we can do and align these to the tasks the customer needs to complete.

- Problem identification – What’s the buyer trying to do? They might be looking at multiple vendors who all actually solve the problem though slightly differently, so they’re trying to validate which is the best fit and confirm the claims that are being made. Help the buyer discern and understand how to quantify not only your solution but also each of these vendors and validate what your competitors are doing.

- Solution exploration – Help the buyer narrow down their options. This sounds simplistic, but recognize a lot of buyers at this stage are overwhelmed by everything they saw from a bunch of different vendors, or they may be excited about new things they hadn’t thought of that are now possible. The trick here is to guide them back to the problem at hand, and if you did the first step correctly, you help them quantify the benefit of solving the problem. You reaffirm the problem and focus them on the key aspects of whatever is going on.

- Requirements building – Whether we like it or not, customers are going validate with other buyers, with external analysts firms, and with industry peer groups. This is to establish performance requirements and the must have functionality they’re looking for in a solution. You must really reaffirm the functional aspects of your technology relative to the problem and then validate it with third party opinions and views.

- Supplier Selection – This is the comparison piece. They’re going to want your product broken down into comparable pieces by area of business and persona. Implementation comes up again. Technologies do different things for different parts of a company. And remember, be proactive on security.

As you’re building out your own cheat sheet around your specific business case, you’re going to have three or four tasks for each of these stages.

Shorten Sales Cycles with Guided Selling Content

Guided selling can help shorten sales cycles. In order to build buyer confidence, you have to create content that is relevant, simple to digest, role specific, and based on quantifiable data. When you use quantifiable data to create relevance, seller conversion rates often see a lift of 30% over qualifiable examples.

There are so many ways to create a guided selling experience:

- Calculators

- Self-driven demos

- 3rd party connections

- Short-form video assets by buyer task

- Benchmarking tools

- Product simulators

- Implementation guides

- Buyer playbooks

The industry is saturated with fantastic options for benchmarking tools and self driven demo solutions right now. Another approach is product simulators that allow you to not only demo in a sandbox environment, but allow you to personalize the experience by role and function. Gather third party content and information that validate the claims you’ve made. Also think of video. It doesn’t need to be Hollywood production level, simply grab a webcam and break your insights into 3 minute chunks. Provide playbooks on how to actually solve their problem. Not the product, the business situation. All of these tools will guide the buyer through the sale and can be used over and over for multiple deals.

The Financial Impact of Demoing

Sales engineers often have to demonstrate the financial impact their solution will have on the buyer’s organization. Like with the list of guided selling tools above, there are several options available, but each has varying levels of trust associated with it for the buyer.

| Trust Level | Measurement | Definition |

| Low | Total Cost of Ownership (TOC) | Fully loaded cost of solution purchase and implementation |

| Moderate | ROI | Net currency benefit over time between the cost of current process less cost of solution plus implementation |

| Moderate | Discounted ROI | Net benefit over time with the provision for the decreased future value of money |

| Moderate | Cost of Delay | Represents urgency of taking an action; typically, the missed ROI for a short period starting at present |

| High | Time to Value | How quickly a customer will see value from a solution |

| High | Net Present Value | Value of the solution taking into account the value of cash inflows and outflows |

Invest in Data Intelligence

The world is becoming more data centric. Understanding where to invest and enable the best conversations with our clients is absolutely what we need to do. Post COVID, the number of virtual meetings grew from 42% to 57% despite how keen many were to meet in person again.

You need to maximize every conversation moment. Think about how we distribute third party content and digital insights across the buying tasks. Are we organizing our assets by customer tasks or do we simply have a repository of content that we send to people when we’re trying to drive engagement? Are we thinking about how we are driving the cadence of information – and there’s absolutely a cadence to how buyers buy. The best presales teams use data platforms that drive buyer engagement.

The way buyers want to be engaged changes with the stages of their buying process. You might start out texting, then having actual conversations, and finally, email. The amount of personalization required also changes as the deal progresses.

Understanding that flow is really important and automating that is key. Guide buyers on what to do next; don’t sit around waiting for them to ask. This is where engineers can help improve the trust with the client and say, “Here’s what we recommend you do next.”

The whole time this is happening, you need to continually be driving insights from other customers back to the buyer as a data driven model. The key is to capture all the data from presales interactions then leverage that data in your organization. You can no longer rely on your CRM to be accurate. You need to be advocating for and building data lakes that are looking at buyer situations and how those situations developed.

Once you understand when and where tasks take place, you can begin to automate the self guidance. Make SE activity available at every stage of the buyer situation. This allows customers to engage with presales on demand without putting undue pressure on the individual SEs.

Because this is how customers want to engage. 63% of customer interaction with vendors is self guided. When you engage personally, 11% is e-mail, 15% is phone or video, and only 11% is in person. If you can get in and out of every in person interaction in 20 minutes or under, you’ll make your customers delighted.

So give the buyers what they want: high impact, hyper personalization content. But capture everything. Don’t let a conversation, a phone call, or a video call go by without it being recorded in some form. This provides a critical competitive advantage.

The Customer’s Buying Journey isn’t Simple

All the different channels, all the different stakeholders coming in at different stages, all the going back and forth between different tasks add up to one thing. The customer’s buying journey isn’t simple. It’s extremely complex and we only get 17% of their engagement!

There’s a bunch of secondary things that the buyer has to do as well like going over digital assets and going back and forth to things like your website.

This is why task completion is huge. How you digitize and how you automate these will allow you to scale, increase close rates, and shorten sales cycles.