Rex Galbraith

CRO Consensus

Rex, CRO at Consensus, has selling in his blood. It only took closing his first deal for him to be ...

Close more deals with

Demo Automation.

Watch a Demo

Sales teams are under increasing pressure to grow revenue while keeping costs under control. But without a clear strategy to improve efficiencies, deals drag on, revenue stalls, and high-value prospects slip through the cracks.

Sales efficiency measures how effectively a company generates revenue from its sales investment. By understanding how to enable buyers, manage the product experience, and implement the right tools, sales and presales teams can maximize resources, improve productivity, and accelerate growth.

What Is Sales Efficiency?

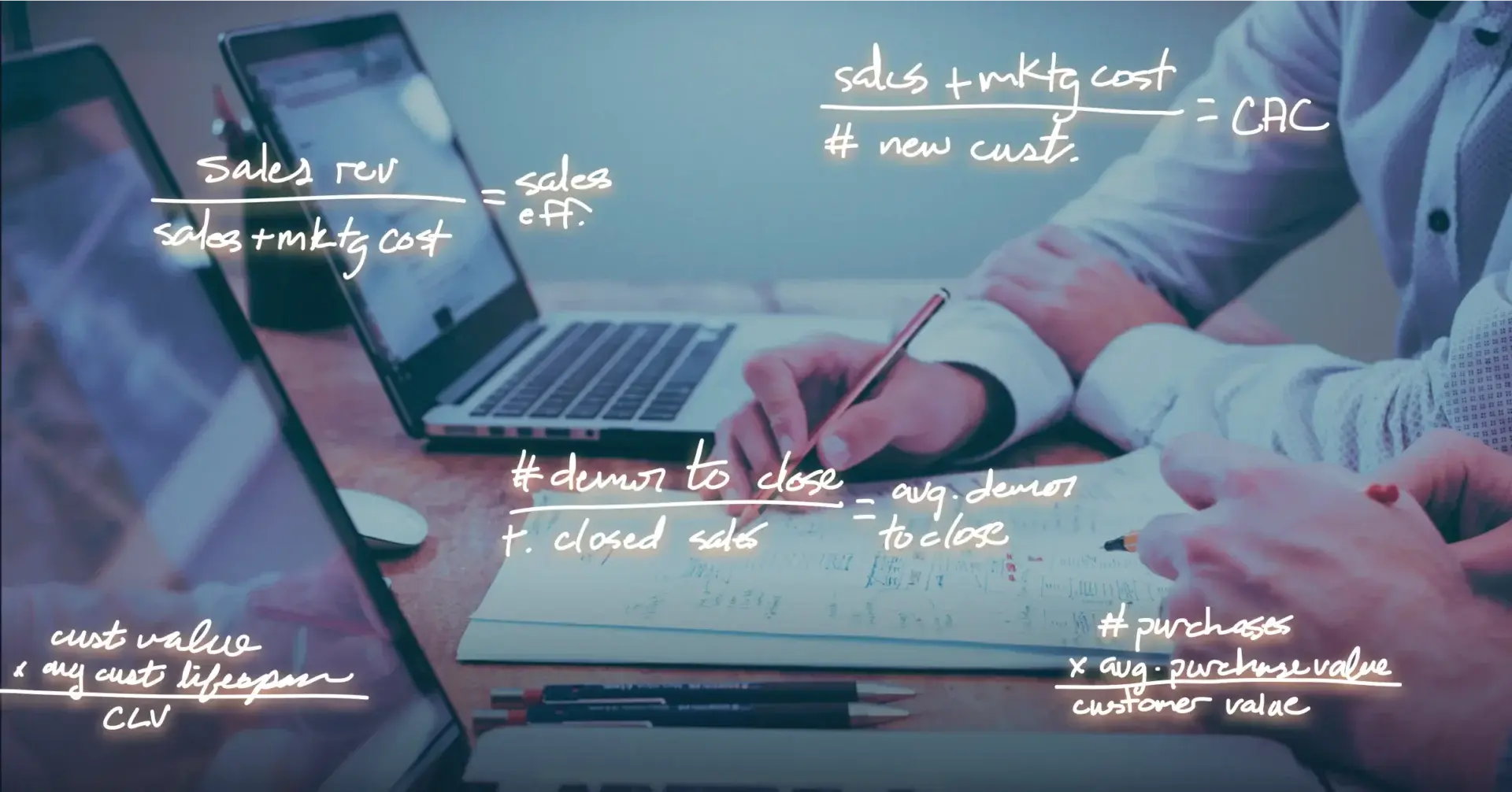

Sales efficiency is a performance metric that compares revenue generated to sales and marketing costs. It helps companies determine how much revenue they gain for every dollar spent on acquiring and converting customers. A higher sales efficiency ratio indicates better resource allocation and a stronger return on investment.

Sales efficiency is commonly calculated using the formula:

Sales Efficiency Ratio = Revenue from New Customers / Sales and Marketing Expenses

This ratio provides insight into how well a company turns investment into revenue. A sales efficiency ratio above 1.0 means the business is generating more revenue than it spends, while a ratio below 1.0 signals inefficiencies that may be slowing growth.

Sales teams can improve efficiency by shortening sales cycles, reducing wasted effort on unqualified leads, and driving buyer enablement. The more efficient your sales team, the more leads and revenue you’ll bring in.

Why Full-Funnel Sales Efficiency Matters

When marketing, sales, and customer success aren’t in sync, things get messy. Deals stall, costs climb, and everyone’s left wondering what went wrong. That’s where full-funnel sales efficiency comes in—keeping every handoff smooth, every touchpoint meaningful, and every effort tied back to revenue.

Think of it like tuning up a relay team. When each leg runs well—marketing warming up qualified leads, sales guiding them with the right product insights, and customer success spotting upsell signals early—momentum builds and nothing gets dropped.

Efficiency isn’t just about speed, though (even if faster deals are a nice bonus). It’s also about focus. Automating repetitive tasks like intro demos or lead qualification frees up time for teams to do what they do best: close deals, coach buyers, and build relationships. And when buyers get personalized content at the right moment, they move forward with confidence.

And the cherry on top? Higher efficiency means generating more revenue without increasing headcount or resources. Companies can reinvest those savings into growth initiatives, creating a compounding effect that boosts long-term performance.

How to Improve Full-Funnel Sales Efficiency and Product Experience

Sales teams that want to maximize efficiency across the funnel need a clear strategy that incorporates buyer enablement tools for aligning every stage of the buyer journey. Each interaction should help prospects advance toward a decision, minimizing wasted effort and delays.

1. Make SMART Goals

Sales cycles accelerate when teams set SMART goals that are specific, measurable, achievable, relevant, and time-bound. Examples of SMART goals might include:

- Improve demo conversions in Q3 by 20%: This goal provides a clear target and actionable focus. Teams can track progress more effectively and adjust quickly when goals are well-defined and tied to measurable outcomes.

- Onboard 1,000 new users by the end of Q1 through warm lead follow-ups: This goal sets a clear timeline, addresses what the end result is, and what tactics the sales team needs to take to reach the goal.

- Generate 50 new product-qualified leads to the sales pipeline through interactive demo engagement: This goal addresses who you’re targeting, how you’re targeting them, and what you want the end result to be.

Setting SMART goals gives teams clarity and creates alignment across sales, presales, and marketing functions. When everyone is working toward clearly defined outcomes, it’s easier to identify gaps in the funnel, optimize the product experience at each stage, and make data-driven decisions.

For example, with the first goal of increasing demo conversions, sales leaders can focus on improving how and when prospects are exposed to product value. That might mean leveraging demo automation software to personalize content based on buyer personas, roles, or industry—so every stakeholder gets the information they need, when they need it.

Presales teams also play a critical role by collaborating on demo content that answers the most common technical and solution-specific questions early in the process. With demo automation capturing and delivering these insights upfront, presales can scale their expertise without having to be in every meeting. This ensures that buyers receive credible, relevant answers that move them forward in the decision process without overloading the presales team.

Marketing, on the other hand, can use insights from demo engagement, like which features prospects are interacting with most, to refine top-of-funnel messaging and campaigns. They can create targeted nurture tracks and retargeting strategies that speak directly to what prospects care about, improving lead quality and warming up buyers before sales even engage. Together, all three teams can help improve demo conversions by 20% in Q3.

2. Clarify Your ICP (Ideal Customer Profile)

Chasing the wrong leads wastes both time and resources. Identifying product-qualified leads ensures outreach focuses on prospects with a high likelihood of purchasing. When defining your ICP, you need to include:

- Firmographic data: Like demographics are to people, firmographics are to organizations. In this section of your ICP, you’ll address what types of organizations your ideal buyers are in, including what industry the business is in, how many people work there, and how much revenue they bring in annually.

- Pain points: To prove to your ICP why your solution is right for them, you need to understand their pain points, or what they would want to use your solution to solve, such as retention struggles or redundant processes.

- Business goals: To demonstrate why your solution is the solution for them, you need to understand their business goals. Break this down further into short-term goals, like growing a client base by 15% over the course of one quarter, and long-term goals, such as raising their next funding round and expanding their marketing and sales teams.

- Buying behavior: Buying behavior tells you what kinds of processes your ICP uses to decide to make a purchase. This helps you tailor your marketing and sales engagement toward the channels your ICP uses. For instance, your ICP might rely on referrals for important buying decisions or prefer the use of self-service tools to research solutions on their own.

- Stakeholders: Since you’re targeting an organization, you need to know who in the organization you need to reach to make a sale. Your stakeholders are the decision-makers you ultimately need to convince to buy.

- Additional attributes: What else can you learn about your customer? Are they early adopters of technology? Or maybe they’re extremely active on social media. These insights help you position yourself in a way that speaks to their interests and desires.

This is where intent-based targeting becomes a game-changer. Use it to attract the right audience from the start—those who are actively searching for solutions like yours. Then layer on lead scoring to prioritize high-intent prospects who are already demonstrating buying behavior.

Consensus’ Demolytics plays a key role in pulling actionable insights from buyer behavior. For example, heat maps show which product features attract the most attention, while engagement data highlights which prospects are closer to making decisions. Sales teams can use these insights to focus on high-value leads, reduce time spent on low-priority activities, and accelerate deal progression.

3. Invest in a Product Experience Platform

Modern buyers don’t just want to see a product—they want to experience it at every stage of their journey. A product experience software creates opportunities for prospects to interact with the product through video demos, guided tours, and personalized content. The best buying experiences engage multiple senses—giving prospects the ability to watch, try, explore, and track their interactions.

- Watch: Video walkthroughs and demos provide a clear overview of product capabilities, building engagement early on.

- Try: Hands-on trials allow prospects to explore features in real-world scenarios, reinforcing the product’s value.

- Explore: Detailed content and product simulations enable buyers to self-educate, uncovering the features and functionality that matter most.

- Track: Every interaction generates actionable insights for sales teams, revealing buyer priorities and deal progress.

By delivering a full-funnel product experience, companies can guide buyers more effectively, reduce friction, and accelerate purchase decisions. Make sure to enhance the product experience with self-guided exploration. You can:

- Offer free trials with in-app onboarding to showcase value immediately

- Offer interactive demos that let buyers explore the product at their own pace

- Use guided product tours to showcase key features before live sales calls

- Provide contextual tooltips and tutorials to reduce friction

Consensus, the first Product Experience Platform, was designed to sell your entire ecosystem, not just a product. The platform empowers teams to accelerate deal cycles and boost revenue by helping them showcase their complete solution, engage all key stakeholders, and proactively address prospect needs with valuable content.

This leads to larger deals with more products per opportunity, reduced deal risk, and a stronger competitive edge. Ultimately, you’re winning more deals by selling the way buyers want to buy—giving you the ultimate sales efficiency boost. It’s no wonder Consensus users see 50% larger deal sizes, double their number of deals, and reduce their sales cycle by 30%.