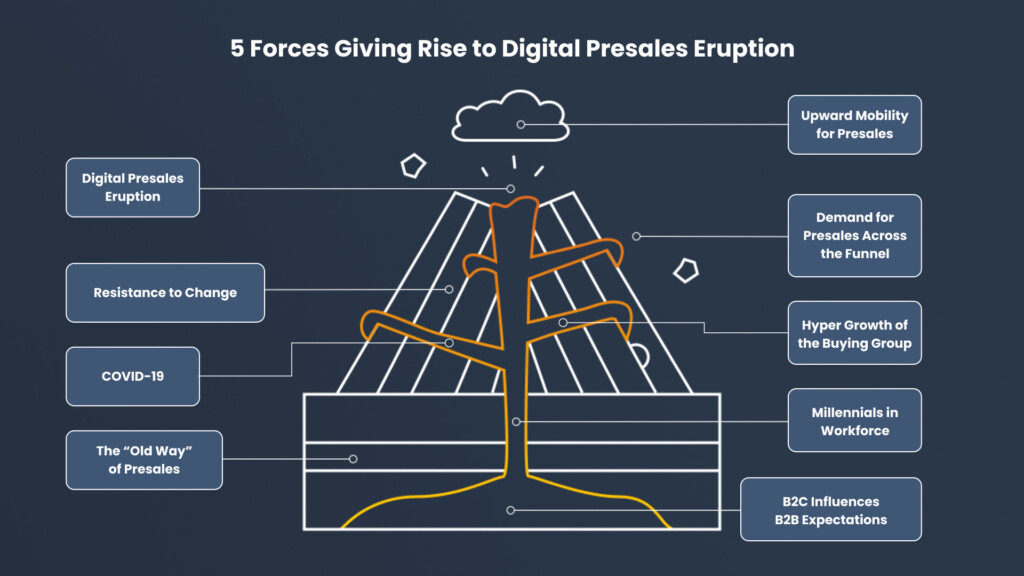

There’s been an eruption in the Presales industry.

I say “eruption” because this is the culmination of multiple forces putting pressure on the industry all at once causing a disruption in the market. And just like an actual eruption, this rapid change to Presales is going to cause disruption as the previous methods for doing things no longer work.

While some may be resistant to change, embracing these changes rather than fighting against them will have an amazing impact on your personal career and benefit your organization from both productivity and revenue standpoints.

1. B2C (Business-to-Consumer) Expectations Are Changing B2B (Business-to-Business)

B2C buying expectations were changed by companies such as Amazon, Tesla, and Apple: one-click purchases, fast delivery, thousands of reviews on each product. The ease of buying from the online retailer made it so many other organizations had to adapt or lose business.

B2C buying expectations have bled over into the B2B world. Stakeholders now want to buy on their own with their own research faster with less hassle. They are demanding digital interactions they can consume on demand while navigating several different channels simultaneously. And they expect a consistent experience throughout.

Research from Gartner shows what buyers want most from vendors are product demonstrations, case studies, and value assessment tools in that order. But that’s the problem. Even though demos are the number one thing they want, they still have to wait up to a week in most instances to see one. More than 20% of buyers have to wait two weeks or more.

Can you imagine if you wanted to buy something from Amazon and it took a week before you could see photos or a detailed description of the product you’re buying? That would be beyond frustrating.

Incorporating B2C buying expectations into your B2B experience will go a long way to creating the experience your customers are looking for. There are six types of demos you can deliver with one click that customers can view on demand. This doesn’t bring every convenience to the B2B experience, but it’s a solid step in the right direction.

2. Millennials Become Management-level Buyers

Already, about 35% of the total workforce is made up of Millennials with research suggesting that number will increase to 75% by 2025. 28% of the current Millennial workforce are managers with 48% of those managers being director level or higher. This means that Millennials’ preferences are starting to drive buyer behavior.

As you read these work preferences, ask yourself how these preferences might influence how you should be adjusting your B2B selling motion.

They generally prefer no sales rep interaction and 70% of Millennial managers favor remote work. They switch jobs more often. It’s estimated 43% will switch jobs within the next two years. They’re asynchronous natives. 75% say that successful businesses allow flexibility. Millennials are more likely to value experiences over items meaning they’re expecting a great buying experience.

Millennials want vendors that are willing to work like them. And they aren’t the youngest demographic in the workforce anymore. Research shows that following generations will require even more flexibility.

Digital Presales needs to adapt to these new generations of buyers.

3. Ballooning Buying Groups

Another massive pressure causing the eruption of Digital Presales is the size of the B2B buying group, sometimes called the buying committee.

The size of the average buying group was 5.4 in 2013, 6.8 in 2018, and as of 2022, Gartner says that number has increased to 13 or 14 stakeholders. That has more than doubled in less than ten years.

The reason this number matters is the size of the buying group directly affects the likelihood of closing a deal. In fact, research by Gartner shows that just one additional person drives the likelihood to purchase down more than thirty percentage points.

Why? Because it’s hard to make decisions together! Just think about the last time you tried to decide where to eat with a big group. Did you find a place everyone actually liked, or did you opt for a place that no one actively disliked? (This is analogous to the deal being lost to the “no purchase” status quo due to a focus on not making waves rather than leading change.)

The same happens in deals. The larger the buying group, the less likely they are to make any decision let alone one that meets everyone’s needs.

4. Pressures from the Pandemic

The COVID-19 pandemic was a major force that changed many industries including presales. Typically a traveling-heavy profession, sales engineers had to quickly figure out how to do presales without going on site.

Even when places reopened offices, not everyone rushed back to work in person. Post-pandemic 70 to 80% of B2B decision makers prefer remote human interactions or digital self-service according to McKinsey and Company. Again, the customer is driving this push towards digital interactions, so we aren’t going to go back to the old ways of doing things.

5. Increased Demand for Presales

Lastly, there’s been an increase in demand for Presale across the whole buying experience. Sales engineers are now being pulled into buying engagements early, mid, late, and even after the purchase. The Consensus 2022 Sales Engineering Workload Report showed that less than 2% of sales engineers support sales exclusively and less than 60% of their time spent on sales at all. With so many stakeholders getting involved, SEs struggle to keep up as their resources get pulled in different directions.

Buyers put a large amount of trust into SEs interactions because they are knowledgeable, consultative, and tell it like it is. One of our customers described the Solution Consulting profession this way, “Presales is the last defense of the truth.” That access to “real stuff” is what buyers want throughout the entire process and they want it as soon as they can get it, not having to wait endlessly to be forced into an outdated selling motion.

Presales teams are stretched very thin trying to accommodate this increase in demand. If you can’t provide this kind of engagement as soon as buyer’s want it, they won’t necessarily drop you, but they will have time to scope out competitors who will.

Conclusion

The Digital Presales eruption has happened, and it is continuing. This shift towards Digital Presales is here to stay.

You can take advantage of and adapt to this disruption if you understand why these changes happened in the first place. In fact, there are presales organizations that are already taking advantage of this Digital Presales eruption and seeing buying cycles cut by more than half. Not only are they meeting the needs of the buyers more effectively, but support from presales technology, such as demo automation, is helping them exponentially scale presales in a way they can meet that increased demand without increasing headcount.

Our next blog covers exactly how you can take advantage of this next stage of Presales’ evolution so you don’t get left behind.